The year is 2025 and on the Australian continent, consulting about sustainability does not exist alongside piles of strategy papers and never-ending recycled graphs. Companies want more than just vision statements—they want frameworks to be implemented, following all regulation and risk processes. One of the most underrated components of this process is the compliance register.

The compliance register, which is often seen as “dull but necessary,” is a powerful tool in the realm of ESG strategy. The leading consultants have started to integrate compliance frameworks with sustainability objectives, as opposed to treating them as a secondary stream of reporting.

This change is not just in the surface layers—it is foundational. Nowadays, saying a company is sustainable without mentioning compliance is simply ambitious. The compliance strategy without sustainability objectives is reckless.

The Integration of the Ecosystems

Due to a lack of engagement, the Australian sustainability as a whole is proposed to work with aspirational sets of key performance indicators with a “net-zero goals.”

This separation is no longer possible. New rules, such as the Treasury’s proposed climate risk disclosure rules, amendments to modern slavery laws, and laws regulating supply chain transparency, require integration. These are not only reputational risks. They are legal, financial, and operational risks in their own right.

In Australia, a leading-edge sustainability professional now assists clients in integrating sustainability risks and responsibilities into the compliance register and transforms it into a dynamic ESG control centre.

Why the illegal Compliance Register is the New ESG Operating System

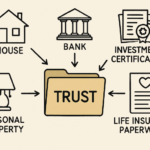

When the compliance register is more than a risk-tracking spread sheet, it is an enforceable ledger of responsibilities an organisation has in relation to climate change, biodiversity, waste, modern slavery, and a number of others.

For example, a register that records a company’s ISO 14001 obligations does not begin to reflect an organisation’s sustainability potential. Protect the register includes:

* Carbon accounting verification (NGER) obligations

* Greenwashing controls under ASIC’s enforcement focus

* Shoot-the moon sustainability-linked finance covenants

* Environmental permits from local councils tied to operational ecosystems

* Compliance with the circular economy of soft plastics and e-waste laws

Sustainability aspirational goals become enforceable.

Accountability Through Action: More than Reporting

In Australia, the ESG landscape is now one with compliance obligations where Australia use to be. Compliance registers are an effective way to bind action to obligation.

Sustainability consultants may appreciate this framework for assigning specific compliance actions to functional owners: procurement for ethical sourcing, operations for emissions monitoring, IT for data governance, and HR for gender equity tracking. Rather than allowing sustainability to wallow in strategic plan appendices, the register operationalizes it, assigning every department ownership of an ESG micro-issue.

This also means improvement in audit readiness. To the question, “What are you doing about your exposure to modern slavery or impact on biodiversity?” you don’t present to them a policy. You show them an obligation, assigned action, evidence trail, and status dashboard.

Most sustainability reports, for example, are retrospective, published on an annual basis and, therefore, out of date the minute they are made publicly available. Nevertheless, compliance registers, especially when they are software driven, provide near real-time data on areas in which a business is lagging.

Sustainability consultants are now advocating for live dashboards tracking ESG compliance metrics to help companies operate in real-time. These dashboards, linked to software such as Lahebo or Skytrust, enable real-time tracking of overdue actions and provide an overview of at-risk metrics.

This is especially relevant for construction, logistics, and manufacturing where compliance frameworks are fluid, and ESG performance increasingly affects the ability to win tenders.

How Legal Defensibility Reframes Sustainability

Sustainability consulting in Australia have evolved from simply leading visioning workshops to playing the vital role of policy, legal, and governance bridge builders.

Sustainability professionals can utilize the compliance register to monitor legal obligations and other emerging “soft law” risks such as climate litigation trends, shareholder activism, and the shifting ASIC interpretations of misleading conduct.

Even emerging compliance requirements that have not yet become law can be entered into the compliance ecosystem to form a solid defensible posture.

Conclusion: The Register as a Reflection of Commitment

Unlike the glossy sustainability reports, the compliance register of Australian businesses speaks volumes on the actual commitment to sustainability. It also demonstrates whether the ESG risks are treated with the same attention as safety, finance, or data protection. It captures the essence of whether a company is simply performing or engaging in corporate posturing.

For most sustainability consultants, the register is treated as a compliance admin function. It is much more than that. It is an invaluable strategic resource, perhaps, the most important sustainability resource in an era with stringent regulations.