Understanding Trust Funding

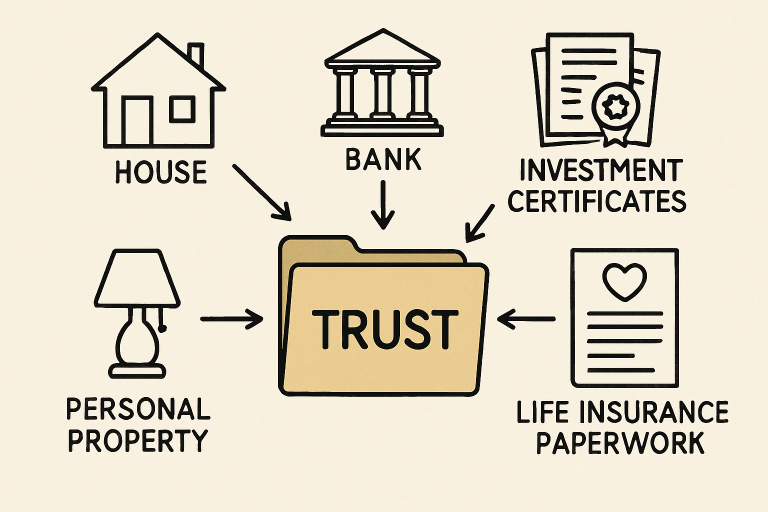

Creating trust is a foundational step in effective estate planning. However, the process does not end with the drafting and signing of trust documents. To ensure a trust successfully fulfills your wishes, you must take the vital step of funding it. This involves transferring legal ownership of your chosen assets, such as homes, bank accounts, or investments, into the trust’s name. Without proactive funding, the trust serves little purpose and may not offer the protection or flexibility you intend. For more information about estate planning, visit lisa-law.com for professional resources and guidance.

Proper trust funding ensures that your assets are managed and distributed in accordance with your instructions. It is not just a legal technicality but a step that prevents complications for your beneficiaries and upholds your legacy. When trusts are left empty, they cannot control or shield any assets, leaving loved ones to potentially face drawn-out court proceedings and public exposure of your estate details.

There is a common misconception that simply signing the trust documents is enough. In reality, the effectiveness of your entire estate plan relies on assets being correctly transferred into the trust’s ownership. This also sets the stage for precise, private, and cost-efficient management of your estate when the time comes.

If you are concerned about ensuring your estate plan meets your goals, professional tools from established organizations such as the American Bar Association can provide helpful guidance.

Consequences of an Unfunded Trust

Failing to fund a trust adequately can have significant impacts on your estate and your heirs. Unfunded or improperly funded trusts leave assets outside of their control, meaning that those assets must go through probate. Probate is not only time-consuming but also expensive and creates a public record, reducing privacy for your beneficiaries. In some cases, probate erodes the estate’s value or can lead to family disagreements as the process unfolds.

Additionally, assets outside a trust may not be distributed as you desire, particularly if conflicting beneficiary designations or intestate succession laws come into play. This misstep directly undermines the primary reason for establishing a trust and may require a costly legal battle to resolve disputes.

Steps to Properly Fund Your Trust

- Real Estate: The title of each property must be changed to the trust’s name. This process involves preparing and recording a new deed with the relevant local government office. Each state has its own rules for deed transfers, so review your jurisdiction’s specific requirements.

- Bank Accounts: Visit your bank or financial institution to retitle any checking, savings, or money market accounts. The bank may require you to close your current accounts and open new ones in the trust’s name. Confirm that account numbers, beneficiaries, and related paperwork are up to date.

- Investment Accounts: Contact your brokerage; they will have specific forms and procedures to transfer the account to trust ownership. Providing a copy of your trust and coordinating with your advisor ensures accuracy, especially for stocks, bonds, or mutual funds.

- Personal Property: Assign high-value personal property such as vehicles, jewelry, art, or collectibles. Document each item’s assignment with a list and a written record attached to the trust, and review state law to determine if titles need updating for cars or boats.

- Life Insurance Policies: Update the policy’s beneficiary designation form to list the trust as the primary or secondary beneficiary (depending on your goals). Review both the trust’s and the insurance policy’s terms to ensure this option is allowed and suitable for your plan.

Assets to Exclude from Your Trust

Not every asset is suitable for holding in a trust. Retirement accounts such as IRAs or 401(k)s have unique rules. Naming a trust as the account owner can cause immediate tax penalties. Instead, for these types of assets, it is usually preferable to designate the trust as a beneficiary, which maintains tax advantages while allowing control over distributions. For a detailed look at retirement account planning, consider Investopedia’s resources.

Regular Review and Maintenance

Once your trust is funded, regular monitoring and updates are key. Life events such as marriages, divorces, or births can affect your estate plan. New assets acquired after the trust is established should also be titled in the trust’s name. A yearly review or an update after any significant change ensures that your trust continues to reflect your intent and covers all relevant assets.

Seeking Professional Guidance

Funding a trust involves legal and financial complexity, with state-by-state variations. Mistakes can disqualify your trust’s protections or result in unnecessary taxes. An estate planning attorney or qualified financial advisor can walk you through the funding process, advising on local laws, proper titling, and appropriate exclusions, and ensure that all paperwork and forms are processed correctly.

Conclusion

Completing the funding of your trust is just as important as creating it. By ensuring every asset is appropriately titled and reviewing your plan regularly, you help avoid probate hassles, court delays, and unintended distributions. These steps provide clarity for your family and peace of mind knowing your wishes will be honored. If you need further support, resources such as lisa-law.com can connect you with professionals who can guide you through each detail of the process.