Looking for a smarter, faster, and more transparent way to secure a personal loan?

In today’s fast-paced world, traditional banks can feel slow, complicated, and sometimes inaccessible. That’s where Upstart comes in. With a technology-driven platform, competitive rates, and user-friendly experience, Upstart is redefining how Americans approach personal loans.

Whether you’re consolidating debt, financing a home project, covering unexpected expenses, or planning a major life event, Upstart provides a modern borrowing solution that combines speed, clarity, and flexibility.

Technology Meets Lending

Upstart stands apart by leveraging artificial intelligence and machine learning to make smarter lending decisions. Unlike traditional lenders that rely almost exclusively on credit scores, Upstart evaluates additional factors such as education, employment history, and financial behavior.

This approach enables more people to access loans at competitive rates, even if their credit history isn’t perfect. By using advanced technology to assess potential, Upstart demonstrates how innovation can make lending more inclusive and fair.

Fast, Transparent, and User-Friendly

One of the biggest pain points in borrowing is waiting. Traditional loan applications can take days—or even weeks—to process. Upstart simplifies this with an entirely online application process, often providing approval decisions within minutes.

Applicants receive personalized rates upfront, understand repayment terms clearly, and can manage their loan entirely online. This transparency eliminates surprises and empowers borrowers to make informed decisions confidently.

For busy professionals or anyone balancing multiple responsibilities, this speed and simplicity are invaluable.

Flexible Loan Options to Fit Your Needs

Upstart offers personal loans ranging from $1,000 to $50,000, catering to a variety of financial goals. Whether you need to consolidate high-interest debt, cover medical bills, fund a home improvement, or finance education, Upstart provides flexibility without unnecessary restrictions.

Loan repayment terms typically range from three to five years, allowing borrowers to select a plan that fits their budget and lifestyle. This level of customization helps users manage financial responsibilities while achieving their goals responsibly.

Competitive Rates That Save You Money

By combining AI-driven underwriting with minimal fees, Upstart often provides lower interest rates than traditional lenders, particularly for borrowers with strong financial potential but limited credit history.

With clear, upfront terms and no hidden costs, borrowers can plan their finances with confidence. Upstart’s combination of accessibility, transparency, and cost-effectiveness makes it a trusted option for personal loans.

Supporting Financial Health

Beyond lending, Upstart emphasizes financial education and empowerment. The platform provides tools and resources to help borrowers understand how loans impact credit scores, manage repayments, and plan for long-term financial wellness.

This commitment to financial literacy ensures that Upstart isn’t just providing money—it’s helping users make smarter financial choices that last.

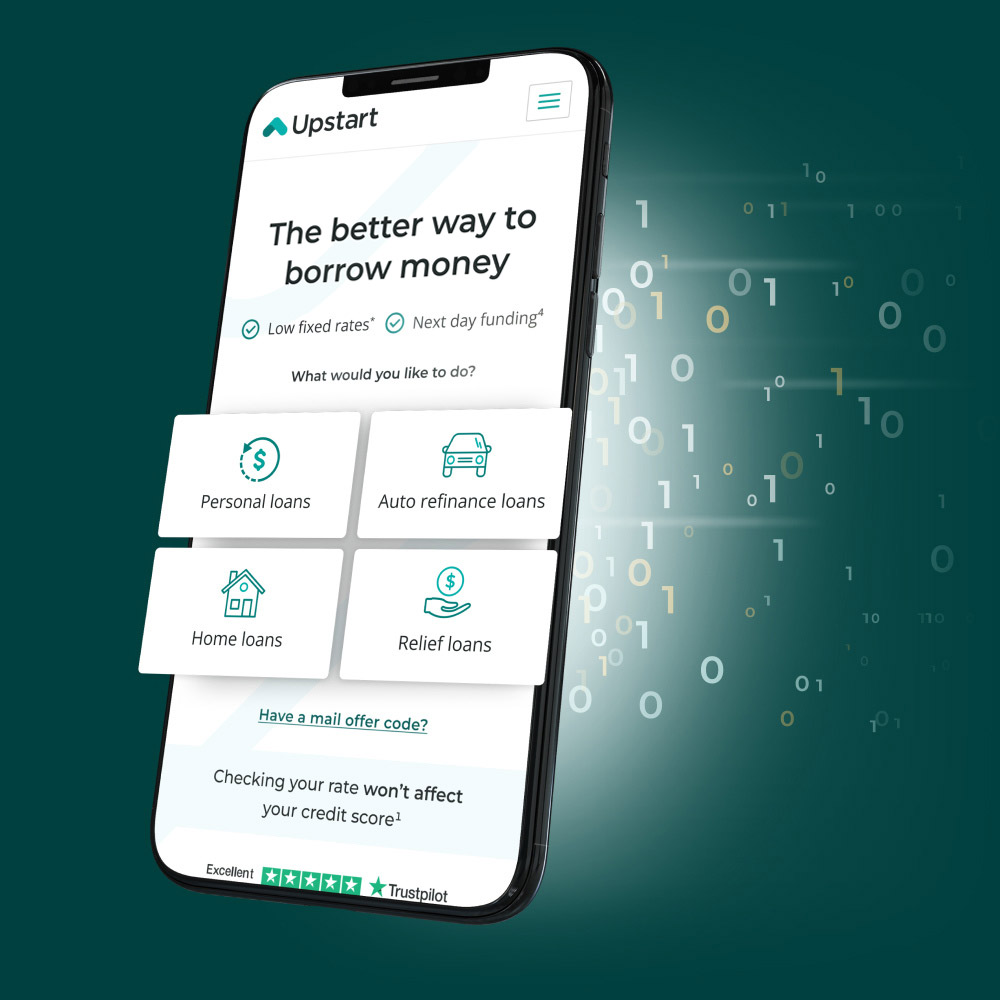

Accessible Anywhere, Anytime

Another key advantage of Upstart is convenience. The online platform allows users to apply and manage loans from any device, whether smartphone, tablet, or computer. There’s no need to visit a bank or navigate complicated paperwork.

This accessibility ensures that personal loans are available to more people, making borrowing less stressful and more efficient.

The Upstart Advantage

Upstart’s combination of technology, speed, flexibility, and transparency positions it as a standout player in the lending market. Borrowers benefit from competitive rates, simple application processes, and personalized loan options that traditional banks often struggle to provide.

Moreover, Upstart’s approach demonstrates how technology can enhance financial services without sacrificing fairness or clarity—an example that modern lenders would do well to follow.

Why Upstart Matters for Today’s Borrowers

In an age of fast-moving finances and growing digital reliance, Upstart addresses key pain points of modern borrowing: slow approvals, opaque terms, and limited access for non-traditional credit profiles. By prioritizing speed, inclusivity, and transparency, Upstart empowers individuals to access funds confidently and responsibly.

For professionals, students, and families alike, this platform offers a practical solution for navigating life’s financial demands efficiently.

Final Thoughts: Borrow Smarter with Upstart

Accessing a personal loan doesn’t have to be stressful or confusing. With AI-driven lending, flexible repayment options, and transparent terms, Upstart provides a modern solution designed to meet the needs of today’s borrowers.

Explore Upstart today and see how fast, smart, and transparent borrowing can transform your financial experience.

Explore Upstart today and see how fast, smart, and transparent borrowing can transform your financial experience.