Dubai’s real estate market continues to combine luxury appeal with strategic investment potential. For first-time investors in 2025, understanding how the market works is essential. Whether you aim to build long-term wealth, generate rental income, or access residency, this guide covers what you need to know.

1. Why Dubai Real Estate Still Matters

Investing in Dubai offers more than just a glamorous lifestyle. With world-class infrastructure, global connectivity, and a high standard of living, the city remains deeply attractive. Financially, Dubai real estate investors benefit from exceptional advantages that set the emirate apart from other global markets. Specifically, the investment environment is appealing because:

- There is no annual property tax on residential properties

- Individual capital gains from property sales are not taxed

- No inheritance tax for property passed to heirs

- Upon property transfer, a one-time 4% fee is levied by the Dubai Land Department (DLD)

This favorable tax environment, combined with residency opportunities, makes property investment in Dubai a compelling opportunity for beginners.

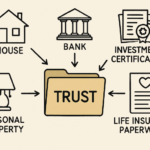

2. Understanding Ownership Rights

If you plan to invest in Dubai real estate, it is critical to understand the legal structure of ownership for non-residents.

Freehold Ownership

Foreign investors can own freehold property in specific designated areas, such as:

- Downtown Dubai

- Dubai Marina

- Business Bay

- Palm Jumeirah

- Jumeirah Lakes Towers

- Jumeirah Village Circle

- Dubai Hills Estate

Freehold ownership grants full, indefinite rights to the land and building.

Leasehold or Usufruct Rights

In areas that are not freehold zones, investment often involves long-term leases (up to 99 years) or usufruct arrangements. These options may cost less upfront but come with more restrictions than freehold.

2025 Updates on Ownership

Dubai has recently expanded its freehold offerings. In January 2025, parts of Sheikh Zayed Road (from Trade Centre Roundabout to the Water Canal) and Al Jaddaf officially transitioned to freehold status. Existing leasehold property owners in these areas can convert their ownership to freehold by submitting an application to the DLD for land assessment and paying a conversion fee of 30% of the property’s valuation. A total of 457 plots became eligible for conversion: 128 plots along Sheikh Zayed Road and 329 plots in Al Jaddaf. These changes make long-term investment more attractive for foreigners.

3. Residency Through Property Investment

One of the strongest draws for property investment in Dubai is its integration with residency options. As of 2025, there are prominent visa pathways for real estate investors.

Two-Year Investor Visa

To qualify:

- Purchase a residential property worth at least AED 750,000

- If the property is mortgaged, at least 50% of its value or AED 750,000 must already be paid

- A No Objection Certificate (NOC) from the bank is required for mortgaged properties

- The property must be in a freehold area

- The visa is renewable every two years and you may sponsor your family

- Applications are processed through the Dubai Land Department

For jointly owned property between spouses, the minimum value must be AED 1 million (AED 750,000 per person).

Ten-Year Golden Visa (Investor)

For longer-term stability:

- Invest in property worth at least AED 2 million

- The property can be mortgaged (minimum 20% down payment)

- You can combine multiple properties to reach the AED 2 million threshold

- Property can be completed or off-plan (if 50% complete or with proof of AED 2 million paid to approved developers)

- Golden Visa holders can sponsor immediate family members

- Visa status only requires entry into the UAE once every two years to remain valid

These updates make the Golden Visa more accessible and encourage investment in both completed and off-plan developments. Always verify the latest DLD and immigration rules or consult a visa specialist.

4. Smart Strategies for First-Time Investors

A thoughtful, well-informed approach is key to success in the Dubai property market.

Choose the Right Location

Established areas like Downtown Dubai, Dubai Marina, and Palm Jumeirah remain popular for their proven track records. Newly opened freehold regions along Sheikh Zayed Road and Al Jaddaf may offer better value and growth potential as they continue to develop.

Compare Off-Plan vs Ready Properties

Off-plan properties offer flexible payment plans and potential appreciation, but carry construction and market risk. Ready properties provide immediate rental income and reduced uncertainty, though often at higher prices. Rental yields in prime freehold areas typically range between 5% and 8% for apartments and villas.

Work with Trusted Professionals

Licensed brokers, real estate attorneys, and independent valuers can help verify contracts, assess developer credibility, and ensure visa compliance. Always ensure your property agent is registered with the Real Estate Regulatory Agency (RERA).

Consider Long-Term Value and Costs

Dubai’s real estate market has seen strong growth, but some segments may face oversupply. Focus on rental income or long-term holding to reduce risk. Plan for recurring costs, including:

- Service charges (typically AED 10 to 30 per square foot for apartments)

- Maintenance fees

- Homeowner association fees

- Municipality housing fees (5% of annual rental value for tenants)

- Property transfer costs (4% DLD fee)

5. Key Risks to Be Aware Of

Even with strong opportunities, investors must remain cautious. Oversupply in certain apartment segments may pressure prices or rents. Off-plan purchases tie up capital until project completion. Regulatory changes can affect visa eligibility and ownership rights. Finally, ongoing operating costs can reduce returns if not carefully managed. Budget for approximately 7% to 10% in additional costs beyond the purchase price when acquiring property in Dubai.

Final Thoughts

Dubai offers a rare combination of lifestyle and financial opportunity, but success comes from strategic planning rather than quick decisions. A first-time investor should select the right area, understand visa opportunities, and work with qualified professionals. Balancing potential rewards with ongoing costs, market risks, and long-term goals is essential. With careful planning and guidance, investing in Dubai real estate can provide both financial security and a high quality of life that reflects your values and aspirations.