Thinking about end-of-life arrangements isn’t easy, but it matters. Pre-planning a cremation helps you take control, reduce stress for your family, and ensure your wishes are honored. It also allows you to decide in advance how to fund those arrangements.

Pre-planning means documenting your final wishes, that’s the “pre-arrangement.” Prepaying means setting aside funds, that’s the “pre-funding.” Doing both gives peace of mind and lifts a huge burden from your loved ones when the time comes.

Here’s the thing, cremation costs rise every year. Prices for transportation, professional cremation services, and merchandise increase with inflation. A prepaid cremation plan locks in today’s prices, so your family doesn’t have to deal with future price hikes.

When you prepay, you know exactly what’s covered and what it costs. Your family avoids unexpected bills and emotional overspending during grief. In many states, pre-funding can also help with Medicaid eligibility by reducing countable assets.

Let’s look at the financial pros and cons in detail.

Key Financial Pros

Here are the key benefits of preplanning your cremation service:

1. Inflation Protection

A prepaid cremation plan shields your family from rising prices. Funeral homes often guarantee today’s rates for services like transportation, direct cremation, and director fees. You pay now, and that’s the final price — no matter what happens to inflation later.

2. Avoid Emotional Overspending

Grief clouds judgment. When families make “at-need” arrangements, they often spend more than planned. Pre-planning avoids that pressure. You decide everything calmly, the urn, the ceremony, and the cost, without emotional strain or sales pressure.

3. Medicaid Eligibility

In some states, an irrevocable pre-need trust helps individuals qualify for Medicaid. Once the funds are placed in the trust, they’re no longer considered part of your estate. This “spend-down” strategy allows you to protect assets while ensuring cremation expenses are covered.

4. Financial Relief for Family

Prepaying removes a heavy financial load from loved ones. They won’t face unexpected expenses while dealing with loss. Instead, they can focus on honoring your life rather than worrying about payments or paperwork.

Key Financial Cons and Risks

Every plan has downsides. Prepaying isn’t always the best choice for everyone.

1. Loss of Investment Growth

If you’re young or healthy, prepaying may not be ideal. Money used for a prepaid plan could earn more in a savings account, CD, or investment portfolio over time. You lose potential growth by locking it into a fixed contract too early.

2. Provider Instability

Not all providers last forever. If the funeral home closes, merges, or goes bankrupt, recovering your funds can be complicated. Your protection depends on how the money was held — in a trust, insurance policy, or other account — and on your state’s regulations.

3. Limited Portability

Moving to another city or state can be challenging. Many prepaid plans are tied to a specific provider. Transferring your plan can be difficult or expensive. Some contracts include cancellation fees or lose their guaranteed pricing if you switch providers.

4. Hidden “Cash Advance” Costs

Prepaid plans usually cover only the funeral home’s services. Other expenses — like death certificates, newspaper obituary fees, and crematory fees — may not be included. These “cash advance” items often rise faster than inflation, leaving your family with surprise costs.

Emotional and Logistical Pros and Cons

Money isn’t the only factor here. Pre-planning also affects how smoothly your final wishes are handled and how your family experiences the process.

Peace of Mind

Pro: Pre-planning brings peace for both you and your loved ones. You know your wishes are in writing. They know decisions are already made. There’s no last-minute stress or confusion.

Con: Over time, families can disagree with earlier choices. Maybe your children want a different ceremony or resting place. If the contract is inflexible, changing it could cause tension or added costs.

Wishes Honored

Pro: Pre-planning guarantees your wishes are respected. You can choose your urn, decide on a ceremony, or specify where ashes should be scattered. Everything reflects your personal values and beliefs.

Con: Plans can be rigid. If you later decide on burial instead of cremation, changing or canceling the plan might mean penalties or losing part of your funds.

Clarity and Organization

Pro: Pre-planning keeps everything organized — paperwork, service details, and any veterans’ benefits. Your family won’t be hunting for documents or trying to guess what you wanted.

Con: If you pass away before finishing payments, your family might have to pay the remaining balance. Some plans require full payment before the services are provided.

3 Ways to Fund a Pre-Planned Cremation

There’s no one-size-fits-all approach to prepaying. The best option depends on your goals — whether it’s flexibility, guaranteed pricing, or Medicaid eligibility. Here are three main funding paths to consider.

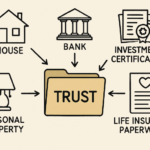

1. Pre-Need Funeral Trust

How it works:

You pay the funeral home directly. They deposit the funds into a state-regulated trust account in your name (or sometimes under the funeral home’s name). The money earns modest interest until it’s used for your cremation services.

Why people choose it:

It guarantees your cremation expenses are fully covered. Funds can be set aside in an irrevocable trust, which may help with Medicaid planning. You get price protection and assurance that the money is used only for its intended purpose.

What to watch for:

Make sure the trust is state-regulated and transferable. Ask if you can cancel or move the plan later. Always request documentation showing where the funds are held and who controls them.

2. Pre-Need Insurance or Final Expense Insurance

How it works:

This is a small life insurance policy designed specifically for end-of-life costs. You pay premiums over time. When you pass away, the benefit goes directly to the funeral home or a designated beneficiary who then pays the cremation expenses.

Why people choose it:

It’s flexible and safer than paying a provider directly. If the funeral home closes, the insurance policy remains valid. Many states also protect these policies through guaranty funds. You can pay monthly, and your family still receives coverage even if the policy isn’t fully paid (depending on terms).

What to watch for:

Policies may include waiting periods before full benefits apply. Premiums can add up over time. Compare total costs to ensure it’s worth it versus self-funding or a direct trust.

3. Self-Funding with a POD Account or Savings

How it works:

You set aside money in a dedicated savings account or Payable-On-Death (POD) account. You name a trusted relative or friend as the beneficiary. When you pass away, they can immediately access the funds to cover cremation costs.

Why people choose it:

It’s the most flexible option. You can move, change plans, or invest the money however you like. There’s no contract, and your funds remain under your control.

What to watch for:

Prices aren’t locked in, and inflation can erode value over time. If you don’t clearly document your wishes, the money could be used differently than intended. Make sure your beneficiary knows your exact cremation preferences and has access to your documentation.

How to Decide What’s Right for You?

Start by asking yourself two questions:

- Do I want to guarantee today’s cremation costs?

- Do I want full flexibility if my situation changes?

If price stability matters most, a prepaid trust or insurance plan may be the best fit. If you prefer control and don’t mind handling the details later, self-funding might make more sense.

It’s also smart to talk with a licensed funeral director or financial planner. They can explain your state’s regulations and help you understand how each funding type affects Medicaid eligibility, taxes, and portability.

Conclusion

Pre-planning your cremation isn’t about focusing on death, it’s about giving your family peace and protecting your finances. You lock in costs, outline your wishes, and reduce stress during one of life’s hardest moments.

Still, it’s not a one-size decision. Weigh the financial benefits against flexibility and growth potential. Make sure the provider is reputable, and keep all contracts and documentation safe.

When done thoughtfully, pre-planning your cremation is an act of love and responsibility. It ensures your final wishes are honored, and gives your loved ones the space to focus on what truly matters: remembering your life, not managing the details.