Introduction

Transitioning into retirement often requires rethinking your living situation to find what’s truly best for your changing needs. Renting is becoming increasingly popular, offering flexibility and fewer home maintenance responsibilities. However, it is important to make informed decisions and avoid pitfalls that can disrupt your peace of mind in retirement. For those seeking guidance on this journey, AARP’s Relocation Decision Guide offers resources and insight into retirement living options to help you make the best choice.

As you consider renting for your retirement years, assessing your current and future needs is vital to ensure that your new living arrangement supports your lifestyle. Whether you’re looking for added convenience, downsizing potential, or more time for leisure, choosing the right rental property like The Villas Retirement Community involves more than simply finding a place to live—it’s about ensuring stability, community, and comfort for years to come.

It’s easy to focus on immediate benefits, such as less home maintenance or avoiding a mortgage. However, neglecting to evaluate the hidden aspects of renting carefully can lead to unforeseen hurdles during retirement. Understanding what to watch for and how to plan can save you unnecessary stress and expense.

This guide covers retirees’ most common mistakes when renting and offers actionable tips for a smoother, more satisfying transition into retirement living.

Overlooking Financial Implications

While renting a home or apartment may seem less financially burdensome than owning, retirees frequently underestimate the long-term costs. Monthly rent payments may initially seem manageable, but remember that rental prices can rise steadily over time. Unlike homeownership, you aren’t building equity with your payments, which could impact your overall net worth.

To safeguard your finances, map out your retirement budget carefully. Assess how fixed or potentially variable rental costs fit into your recurring income from retiree benefits, pensions, or savings. Additionally, be mindful of hidden expenses such as renters’ insurance or maintenance fees that may surface unexpectedly. AARP offers further guidance on calculating actual housing costs in retirement.

To safeguard your finances, map out your retirement budget carefully. Assess how fixed or potentially variable rental costs fit into your recurring income from retiree benefits, pensions, or savings. Additionally, be mindful of hidden expenses such as renters’ insurance or maintenance fees that may surface unexpectedly. AARP offers further guidance on calculating actual housing costs in retirement.

Ignoring Lease Terms and Conditions

Lease agreements can appear straightforward, but retirees often make the mistake of skimming the details. Failing to read and understand all lease conditions may lead to unpleasant surprises—such as strict rules on rent increases, ambiguous maintenance responsibilities, or penalties for early termination. Reviewing every lease and negotiating terms when necessary thoroughly is crucial, so you retain control and are protected if unforeseen circumstances arise.

Neglecting to Research the Neighborhood

When choosing a retirement rental, location is as essential as the property. Some retirees rush, drawn by attractive interiors or amenities, but overlook vital neighborhood factors. Investigate the community’s access to healthcare, grocery stores, and public transit. A supportive, friendly neighborhood will be key to your quality of life and social engagement as you age. For in-depth information, AARP details considerations for senior housing.

Underestimating Future Health Needs

It’s not always easy to anticipate future health needs, but overlooking this aspect when renting can become a significant obstacle. Select properties with accessibility features like ramps, walk-in showers, and elevators. Evaluate proximity to hospitals and emergency care—these factors may seem less urgent now, but will be invaluable if your health circumstances change.

Overlooking Community Amenities

Many retirement communities and modern rental complexes offer a variety of amenities, from fitness centers and recreation rooms to organized events and on-site maintenance. Skipping these in your assessment could mean missing out on socialization, wellness, and convenience opportunities that can enhance your retirement experience. Prioritize properties that align with your hobbies, preferences, and social interaction needs.

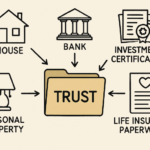

Failing to Plan for Long-Term Stability

Short-term leases and frequent moves may start feeling adventurous, but they can become stressful and costly as you age. If stability is essential for your sense of security or well-being, pursue rental agreements offering renewal options, fixed rent terms, or long-term contracts. This helps protect against instability and ensures a consistent environment for years.

Not Considering the Total Cost of Living

The monthly rent is just the tip of the iceberg regarding total expenses. Utilities, parking, internet, insurance, and transportation costs all contribute to your cost of living. Don’t forget to account for local property taxes (even if paid by the landlord, they can affect your rent) and any strata or association fees if you’re renting in a managed property. Creating a comprehensive monthly budget—ideally with the help of a financial advisor—will help avoid unpleasant financial shortfalls.

Skipping Professional Advice

Retirement is a significant life change, and the right rental property is essential to your happiness and security. Consulting with a financial planner or real estate professional specializing in retirement living can provide invaluable insights tailored to your needs and goals. Professional advice ensures you don’t overlook key factors or make hasty decisions in the excitement of change.

Conclusion: Make Your Rental Transition Smooth and Secure

Careful planning and attention to detail can prevent these common rental mistakes and set the stage for a fulfilling retirement. By factoring in your financial situation, lease terms, future health needs, neighborhood quality, and professional advice, you’ll be better equipped to choose the best rental that serves you now and into the future. Thoughtful choices today mean less stress and more enjoyment in your retirement years.