In finance, a single moment’s delay can have a ripple effect. One missed approval, one lost document, or one unvalidated data point can cascade into regulatory infractions or client distrust. Traditionally, all these risks have to be managed through endless manual checks and constant surveillance — but that does not scale anymore.

The best project management tools for financial services now do more than track tasks — they create control. By connecting departments, automating decision flows, and building traceable records, Lark enables firms to reduce risk while accelerating operations. It turns compliance from a reactive process into an automated framework of protection.

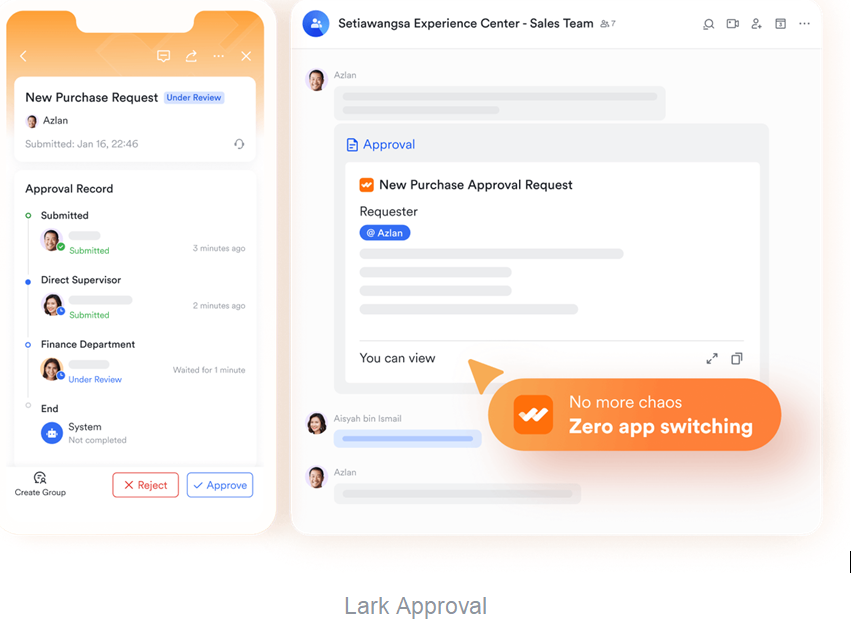

Lark Approval: Making governance automatic

Every financial institution lives by its approval chains. Whether it’s sanctioning high-value transfers, onboarding corporate clients, or reviewing investment proposals, decisions must move fast — but also leave a clear trail. Lark Approval replaces manual sign-offs with intelligent, automated workflow routing that ensures every authorization follows a structured, auditable path.

Picture a regional credit risk team scrutinizing a million-dollar loan. The moment the analyst puts the case in, Approval sends it through pre-determined levels: risk review, compliance, senior management. All reviewers get context-rich submissions — appended financial models, client profiles, and prior correspondence — everything in one electronic workspace. The instant someone approves or raises an issue, notifications cascade instantly across time zones.

The outcome is not only speedier approvals but steady governance. Each decision is timestamped, recorded, and accessible for regulators. What once took days of tagging and retagging email threads now occurs frictionlessly, with inherent accountability and no vagueness.

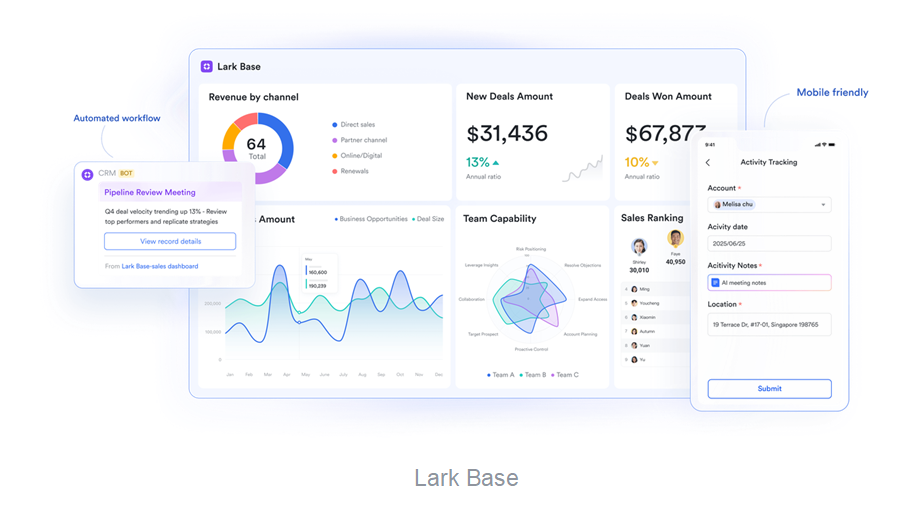

Lark Base: Turning scattered data into visibility

In financial services, the danger of risk is often lodged in fragmentation. Transaction data resides in one system, compliance reporting in another, and client information somewhere else altogether. Lark Base turns that around by becoming a live operational database — one source of truth where all records are linked, validated, and updated in real-time.

As an example, a private wealth management company can utilize Base to keep up-to-date KYC verification status, investment mandates, and real-time portfolio risk profiles. When a compliance analyst makes a change to one client’s file, the information is immediately reflected on operations and management dashboards. No version discrepancies, no stale reports.

Base empowers executives to view patterns of exposure and operational holes before they turn into incidents. It shifts data from being static repositories to predictive control layer — one that enables leaders to navigate uncertainty with clarity.

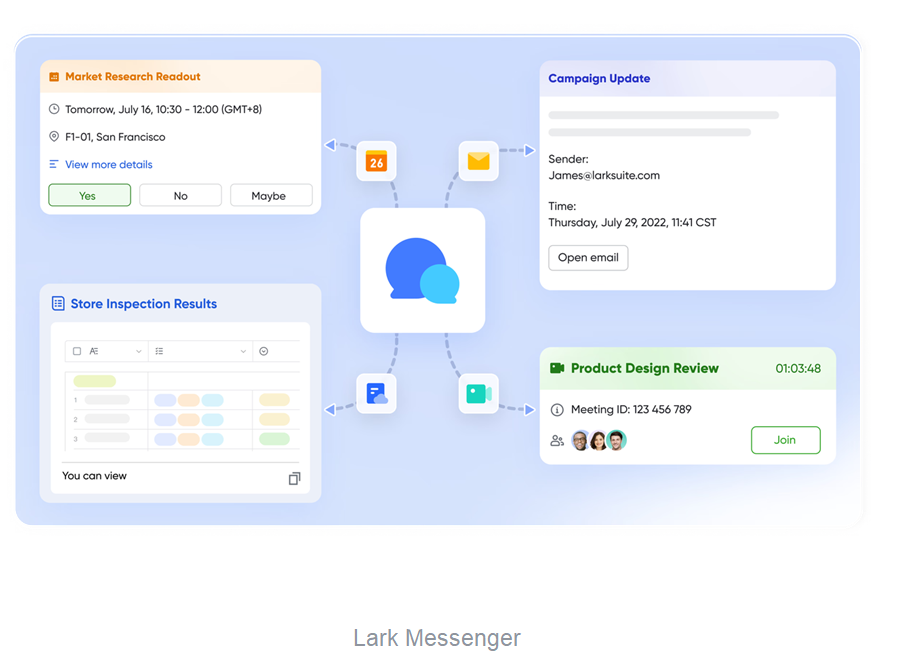

Lark Messenger: Communication that protects context

Breakdowns in communication are one of the largest risk areas for operations in finance. Life-changing updates hidden in email, approvals hidden in chat conversations — it’s how little errors become big compliance failures. Lark Messenger makes internal communication a systematic, transparent process, which keeps every conversation tied to the data that matters.

Imagine a global investment team negotiating bond allocations between London, New York, and Hong Kong. Rather than isolated conversations and forwarded files, teams negotiate positions directly in Messenger channels connected to live dashboards in Base. Risk officers can later review the entire conversation history — all messages, decisions, and attached documents captured in one location.

Messenger prevents any instruction lost, any record forgotten. It’s quick enough for trading desks but compliant enough for audits — combining communication agility with institutional control.

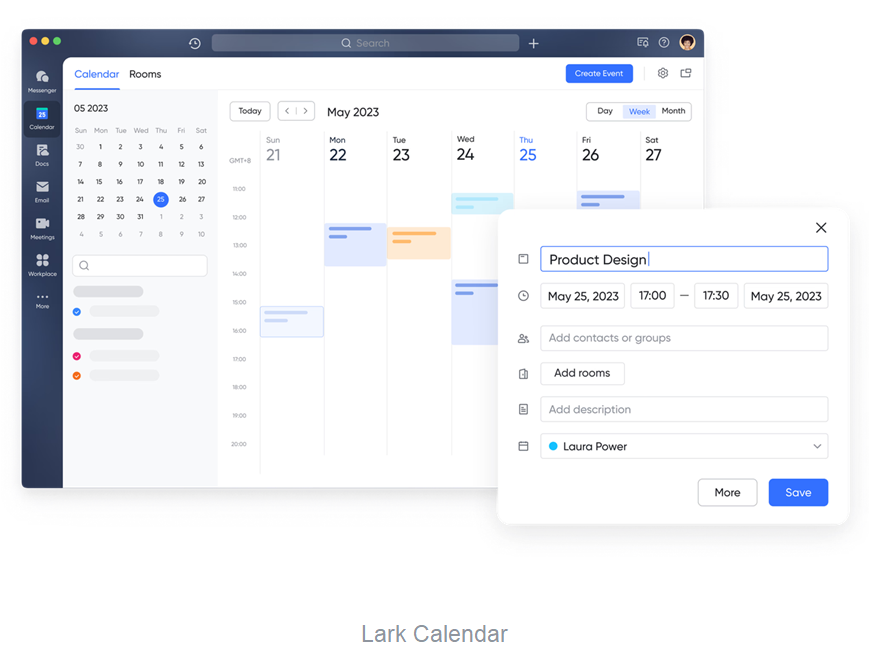

Lark Calendar: Aligning oversight with precision

Timing is the key to financial performance — and risk tends to emerge when monitoring gets out of sync. Lark Calendar synchronizes scheduling, compliance checks, and reporting cycles so that governance occurs on time, every time.

Take the case of a global bank overseeing quarterly audits between continents. Audit committees, finance departments, and regulators are based in varying time zones, but Calendar synchronizes each session automatically. It links agendas, previous reports, and Base dashboards to events so that participants come prepared to discussions. When review schedules change, reminders update immediately for all parties involved.

Calendar makes oversight an ongoing process rather than an occasional rush. With each meeting, filing, and follow-up laid out for all parties to see, financial institutions are in control not by pursuing timetables — but by remaining constantly in sync.

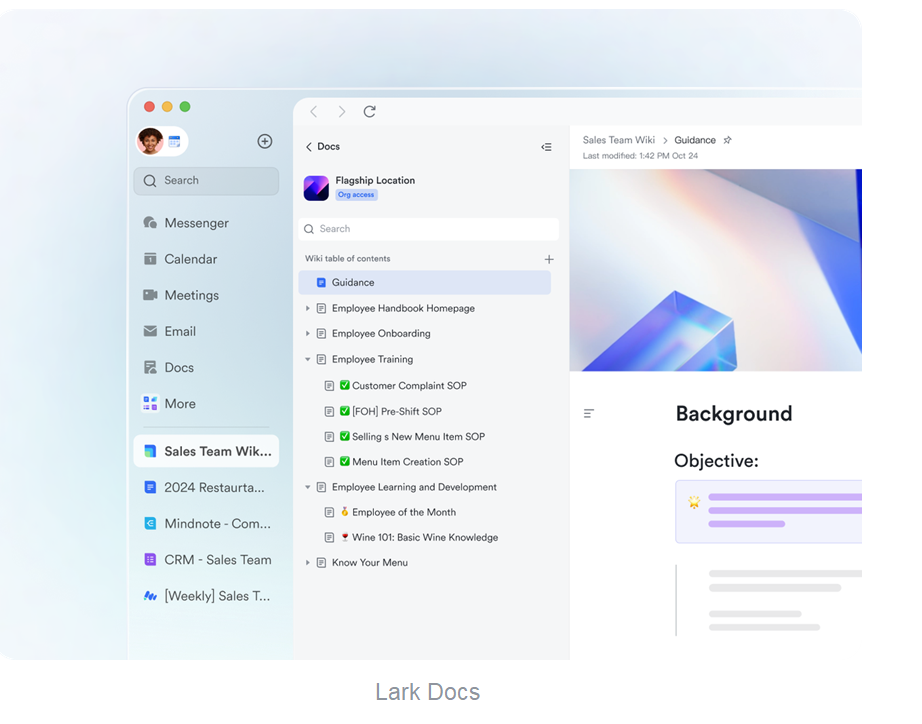

Lark Docs: Keeping documentation current and compliant

Documentation is the foundation of financial regulation. Policies, disclosures, risk reports, and regulatory filings all have to be accurate, trackable, and current. With Lark Docs, compliance documentation adapts in real time — without version control chaos or attachment emailing.

When a compliance officer updates an internal AML process, the change occurs in a live Doc shared with legal, operations, and audit teams. The document is directly linked to Base data, so the most current risk metrics or customer information is automatically updated. All changes are logged, checked, and authorized within the same document.

When auditors ask for proof of compliance, teams don’t waste hours looking for the “latest version.” Docs makes regulatory readiness an everyday state — not a quarterly crisis.

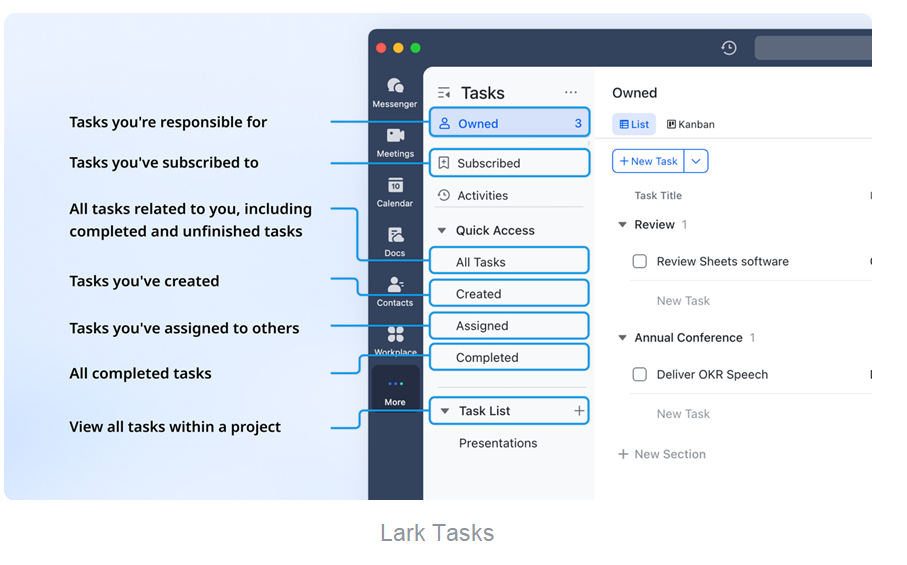

Lark Tasks: Ensuring accountability in every review

The last action in any risk process is implementation — making sure that found issues become finished tasks. Lark Tasks adds organization to that responsibility, turning compliance checklists and audit findings into visible, traceable workflows.

Once an internal audit detects gaps — for example, delayed KYC checks or incomplete reconciliations — Lark Tasks initiates follow-up actions for responsible teams automatically. Progress reports feed into Base, and completion rates are monitored by managers in real time. In case of slippage on deadlines, automatic notifications alert leadership before noncompliance is at issue.

Tasks completes the circle between discovery and closure. It makes sure risk management does not stop with reporting — it stops with outcomes. And in an industry where every unchecked box means a fine or lost license, that level of control sets up long-term stability.

Conclusion

Risk in financial services can’t be eliminated — but it can be managed intelligently. By automating workflows, connecting data, and embedding compliance into every action, Lark helps financial institutions stay agile and audit-ready simultaneously.

Approvals move faster, data stays clean, communication remains contextual, and every task is visible until resolved. It’s not about working harder — it’s about designing systems that protect value at every step.

With Lark’s project management software, financial services companies don’t just reduce risk; they make compliance and control part of how they grow. It’s not automation for efficiency’s sake — it’s automation for trust, precision, and the long-term integrity of the entire business.