Introduction

Small business owners play a pivotal role in the American economy, driving local development, generating job opportunities, and fostering innovation. Yet, keeping up with legislative and regulatory changes is one of their most significant challenges. The legal landscape for small businesses is rapidly evolving, especially with recent federal measures targeting transparency and anti-fraud protections. Understanding these changes and ensuring your business’s legal rights are safeguarded is crucial. For those seeking specific legal advice or help drafting compliance procedures, working with a Business Attorney Denver is one proactive step towards protecting your enterprise as rules shift.

In today’s business climate, knowledge is essential. Small business owners must be equipped to comply with the law and take advantage of opportunities created by new regulations. Major legislative shifts like the Corporate Transparency Act mean that every business owner should remain informed, organized, and responsive to ensure smooth operations.

The regulatory environment is dynamic, and non-compliance can result in monetarily and reputationally hefty penalties. It is important to consider joining professional networks, seeking legal guidance, and using resources to help small businesses stay ahead of changes.

Transparent business operations improve credibility and help businesses fend off potential legal disputes and regulatory enforcement. Arming yourself with the latest information puts your company in the best position to grow and endure.

Corporate Transparency Act Overview

Corporate Transparency Act Overview

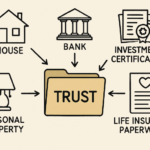

Enacted in 2021, the Corporate Transparency Act (CTA) is a cornerstone in the U.S. government’s efforts to combat money laundering, terrorism financing, and other financial crimes. The CTA requires all corporations, LLCs, and similar entities registered with a state to report their beneficial ownership details to the Financial Crimes Enforcement Network (FinCEN). These details include full legal names, dates of birth, current addresses, and unique identifying numbers from official documents such as driver’s licenses or passports.

The intention is to close loopholes previously exploited by anonymous shell companies engaged in criminal conduct. This regulation is projected to impact approximately 32.6 million small businesses nationwide. Business owners unaware of these requirements may inadvertently risk non-compliance penalties. It is imperative that they become familiar with what information must be reported, who qualifies as a beneficial owner, and how their information will be protected.

Legal Challenges and Current Status

The CTA’s broad reach and strict reporting obligations have sparked legal debates, particularly concerning privacy rights and administrative burdens on small business owners. In March 2024, a federal district judge in Alabama declared key elements of the CTA unconstitutional, raising questions about whether the federal government could require such invasive reporting. However, despite these attacks, the Supreme Court has allowed the CTA’s enforcement to proceed, with full effect beginning January 2025. According to Forbes, ongoing opposition—especially from groups like the National Federation of Independent Business (NFIB)—focuses on protecting small businesses from excessive compliance costs and potential privacy risks.

The legal climate remains fluid, and while implementation is moving forward, litigation and advocacy efforts may ultimately modify how some aspects of the CTA are applied in the future. Small business owners are encouraged to monitor federal decisions and applicable state responses to stay informed of new developments.

Small Business Bill of Rights

As small businesses grapple with the changing regulatory framework, advocacy organizations like the U.S. Chamber of Commerce have proposed guiding principles to secure business owners’ rights. The Small Business Bill of Rights articulates core policy goals, such as the right to be protected from unduly burdensome regulations, a fair and competitive environment, and the right to participate in workforce decisions. This framework is increasingly cited in federal policy conversations and can serve as a rallying point for business owners seeking to influence new laws and regulations.

By leveraging these rights, small business owners can advocate for improved conditions and benefit from a clearer understanding of what they should expect in terms of federal and state support for entrepreneurship. For more on the Small Business Bill of Rights and advocacy opportunities, visit the U.S. Chamber of Commerce.

Compliance Strategies for Small Businesses

Proactive compliance is key to managing regulatory obligations like those the CTA imposes. Small business owners should:

- Use trusted news sources and guidance from industry associations to stay informed on legal updates at the federal and state levels.

- Consult with qualified legal professionals to interpret reporting requirements and their applicability to your business model.

- Maintain organized and up-to-date records to streamline the reporting process and support audits if necessary.

- Network with peer businesses and advocacy groups for support as regulations evolve and new challenges arise.

Moreover, digital record-keeping systems can greatly improve efficiency and reduce the risk of non-compliance, which is especially pertinent given the Treasury Department’s growing emphasis on enforcement. Resources from industry leaders like Forbes provide valuable insights into best practices for ongoing compliance.

Potential Penalties and Enforcement

The consequences of failing to comply with CTA provisions are significant. Non-compliant businesses may face civil penalties of up to $500 per day, criminal fines as high as $10,000, and even imprisonment for willful violations. Early enforcement signals from the Treasury Department indicate that scrutiny will only increase once the CTA takes full effect in January 2025. Ignorance of the law is not a defense, so business owners must prioritize compliance in their yearly legal reviews.

Proactive monitoring, early intervention, and professional legal advice are the most effective shields against these risks. Immediate action on compliance will minimize exposure to these steep penalties.

Resources and Support for Small Businesses

Fortunately, small business owners do not have to navigate these complex waters alone. Multiple national and local organizations offer invaluable resources, including:

- The National Federation of Independent Business (NFIB), which provides legal advocacy and education.

- The U.S. Chamber of Commerce, through its Small Business Bill of Rights initiative and related legal toolkits.

- Small Business Development Centers (SBDCs) offer free, personalized consulting and training for compliance issues.

- The official FinCEN Beneficial Ownership Information webpage has the latest reporting details, forms, and guidance for the CTA.

These organizations help business owners adapt to legal obligations and build a robust foundation for ongoing growth and success.

Conclusion

Small business owners play a central role in the country’s economic fabric. By staying alert to regulatory changes like the CTA, advocating for their rights, and leveraging available legal and compliance resources, business owners can protect their companies from risk and foster lasting success. Continually educating yourself, consulting experienced professionals, and cultivating robust compliance habits will ensure your business can meet new challenges head-on and thrive in a changing legal environment.